EST with mutual funds. Here are the details.

Etf Vs Index Funds 6 Factors To Know Which Is Better To Invest

How to Invest in Mutual FundsETFs 4 Easy Steps.

. With over 13000 mutual funds from leading fund families and a broad range of no-transaction-fee NTF funds mutual fund trading at TD Ameritrade covers a range of investment objectives philosophies asset classes and risk exposure. Both institutions and individuals could see. Since their introduction in 1993 exchange-traded funds ETFs have exploded in popularity with investors looking for an alternative to mutual funds.

Rather than selling and redeeming shares as needed closed-end funds sell a fixed number of shares via an initial public offering IPO. Please note this security will not be marginable for 30 days from the settlement date at which time it. They offer many advantages over conventional mutual funds as well as exchange-traded-funds ETFs.

Its remained valuable throughout history. New to investing and want to get a better understanding of what ETFs and Mutual Funds are and how theyre different. Here are a few advantages of mutual funds.

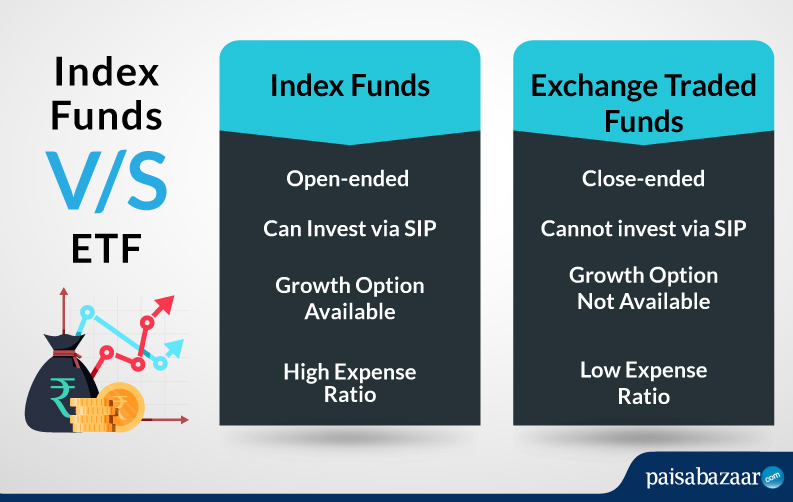

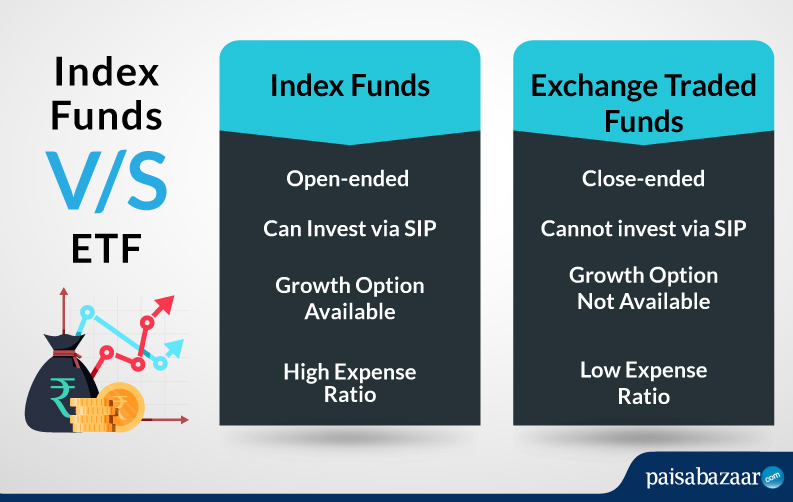

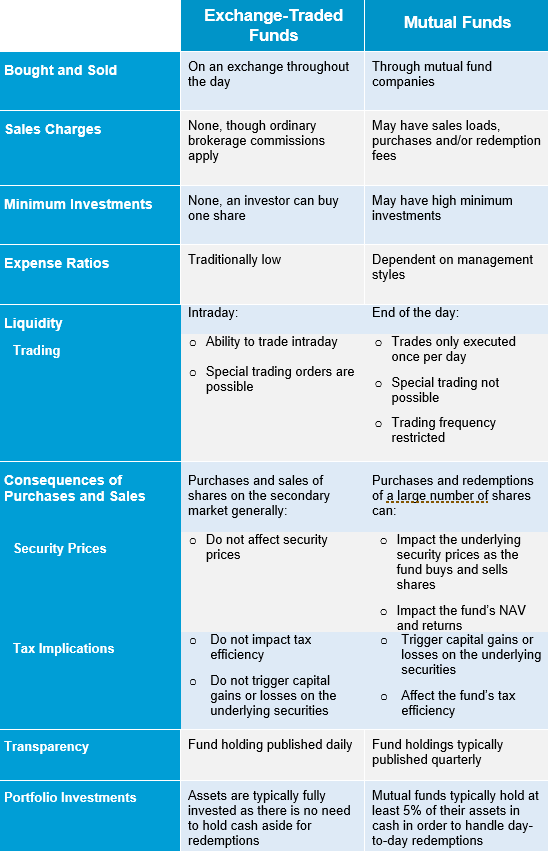

ETFs are often cheaper than mutual funds. The advantage of an ETF is that it allows intraday trading whereas most mutual funds price only once at the end of the day. There are gold hedge funds exchange-traded funds gold-backed securities gold mining stocks gold mutual funds and gold futures options to choose from.

Advantages of investing in mutual funds. The first and most obvious step is simply to purchase and hold them inside a tax-deferred or tax-free account such as a traditional or Roth IRA or qualified retirement plan. If all mutual funds sell holdings and pass the capital gains on to investors as a taxable event then we have found a winner for the list of.

Mutual funds are available directly from fund providers whereas ETFs. Many index mutual funds offer additional flexibility by providing ETF counterparts. Your funds will grow faster in these plans over time because the money that.

Many ETFs also come with a lower expense. That said mutual funds have advantages over some types of investing like individual stock picking. Check out our card stacks.

All securities have an active dividend policy and are either exchange-listed or domiciled in. Different methods of investing in gold can result in a nice profit. ETFs are subject to market fluctuation and the risks of their underlying investments.

Closed-end funds are similar to conventional managed mutual funds but with one major difference. For example Vanguard offers the Vanguard SP 500 ETF along with the Vanguard 500 Index Fund. Unlike mutual funds ETF shares are bought and sold at market price which may be higher or lower than their NAV and are not individually redeemed from the fund.

EST with ETFs rather than receive prices as of 400 pm. The securities listed in this page are organized into two tables. Among the many advantages of ETFs is their relatively low expense ratios compared to similar mutual funds.

ETFs are subject to management fees and other expenses. Of course those ETFs that are actively managed do incur slightly higher costs but are. Here are the details.

Passive investing is cheaper to set up than active management where the fund company must pay a team of experts to analyze the market. The stock table includes relevant common stocks ADRs and preferred shares and the funds table includes relevant exchange-traded funds ETFs and institutional share class mutual funds. We have you covered.

There are several key steps that you can take to reduce the tax bill you receive from your mutual funds each year. For iShares ETFs Fidelity receives compensation from the ETF sponsor andor its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain FBS platforms and investment programs. Able to react quickly to changing market conditions.

We have you covered. Gold has been used as a currency for many years. The investors journey begins by understanding a simple distinction.

If you decide to invest in ETFs over mutual funds because your order can be filled at 350 pm. The disadvantages of mutual funds will probably outweigh the benefits for most investors. Mutual Funds Have High Capital Gains Distributions.

Use our tools and resources to choose funds that match your objective.

Etf Vs Mutual Fund What S The Difference Ally

Difference Between Tax Etf And Mutual Fund Difference Between

Key Considerations Comparing Mutual Funds And Etfs Ultimus

Trade Etfs Exchange Traded Funds Your Guide To Etfs Trading Capital Com

0 Comments